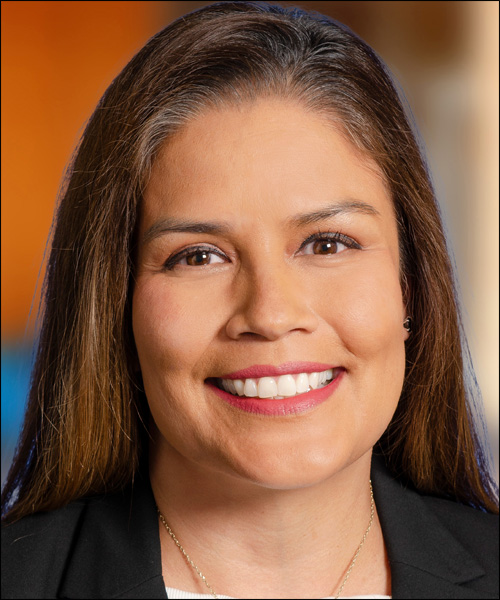

On June 4, Caroline Jones, commissioner of the Texas Department of Savings and Mortgage Lending, announced her retirement, effective August 31. She joined the department in 2008 and was appointed commissioner in 2014. Prior to joining the Department of Savings and Mortgage Lending, Jones served as in-house counsel for financial institutions for more than 20 years. Her main area of practice has been residential mortgage lending.

On June 4, Caroline Jones, commissioner of the Texas Department of Savings and Mortgage Lending, announced her retirement, effective August 31. She joined the department in 2008 and was appointed commissioner in 2014. Prior to joining the Department of Savings and Mortgage Lending, Jones served as in-house counsel for financial institutions for more than 20 years. Her main area of practice has been residential mortgage lending.

“It has truly been an honor and a privilege to serve for seven years as commissioner,” Jones wrote in a statement announcing her retirement. “You have been part of what has made this such a wonderful opportunity and I will miss you. I strongly believe in the importance of the Texas thrift industry and the Texas mortgage industry and the Department of Savings and Mortgage Lending’s role in both.”

Jones received her undergraduate degree from Sophie Newcomb College of Tulane University and her law degree from St. Mary’s University School of Law. She is a graduate of the Governor’s Executive Development Program through the Lyndon B. Johnson School of Public Affairs and is also a graduate of Leadership Austin. Jones currently serves on the board of the American Council of State Savings Supervisors and previously was board chair. She served for four years as a member of the Federal Financial Institutions Examination Council state liaison committee. Jones has served on the boards of Habitat for Humanity, Center for Battered Women (now SAFE Alliance), Junior League of Austin and Caritas of Austin.

The Texas Department of Savings and Mortgage Lending is subject to the oversight, and is under the jurisdiction of, the Finance Commission of Texas. The department has two key areas of regulatory responsibility: the chartering, regulation and supervision of the state’s thrift industry, and the licensing/registration and regulation of the state’s mortgage industry. These two areas of responsibility cover the vast majority of residential mortgage lending in Texas. The department:

- Regulates state-chartered savings banks with combined assets of more than $24.4 billion;

- Regulates more than 26,000 residential mortgage loan originators throughout Texas;

- Regulates approximately 2,000 mortgage-related entities; and

- Investigates and resolves consumer complaints related to mortgage origination.