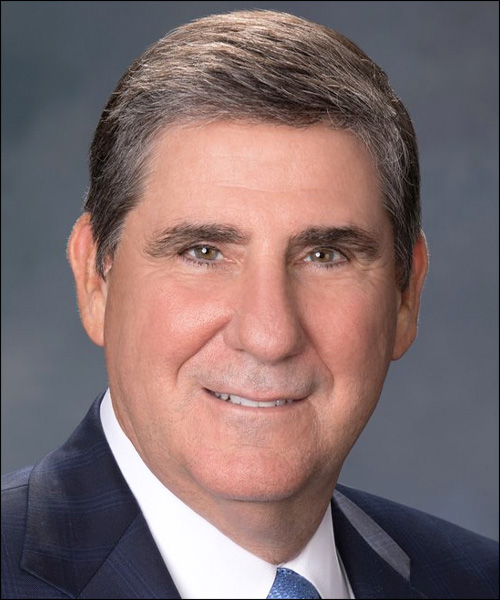

Dallas Capital Bank recently promoted Jason Matthews to chief banking officer. He will be responsible for managing the bank’s client-facing lines of business, including commercial banking, private banking, commercial real estate and deposit and treasury management. Matthews joined Dallas Capital Bank in 2015 and most recently served as executive vice president, managing the bank’s commercial banking and private banking divisions.

Dallas Capital Bank recently promoted Jason Matthews to chief banking officer. He will be responsible for managing the bank’s client-facing lines of business, including commercial banking, private banking, commercial real estate and deposit and treasury management. Matthews joined Dallas Capital Bank in 2015 and most recently served as executive vice president, managing the bank’s commercial banking and private banking divisions.

“Jason’s leadership and passion for serving our clients have been key to our growth as an organization over the past six years,” says Douglas Hutt, chairman and CEO. “As chief banking officer, he will continue to build upon the foundation we created when we started the bank—to create a world-class banking experience, combining talented bankers and state-of-the-art deposit and treasury technology with white-glove-level service and local decision-making.”

Matthews’ new leadership role is one of several recent promotions and organizational changes for Dallas Capital Bank as it continues to position itself for continued growth after ending the year with more than $1 billion in assets.

In addition to serving as the bank’s treasury management executive, Wendy Blackwell will now also serve as director of new product development, reporting directly to Matthews. She will focus on developing new innovative banking products and services for clients.

In addition to serving as the bank’s treasury management executive, Wendy Blackwell will now also serve as director of new product development, reporting directly to Matthews. She will focus on developing new innovative banking products and services for clients.

“Wendy has done a phenomenal job in building our deposit and treasury management team over the past six years, and her additional role in product development will allow us to further accelerate our investment in deposit and treasury technology,” Matthews says. “We are incredibly proud of the success we’ve achieved together since we formed the bank in 2015. However, we are even more excited about the potential still ahead in truly becoming the premier commercial bank in Dallas/Fort Worth.”

Established in 1972, Dallas Capital Bank is a Dallas-owned and managed commercial bank.