On November 9, Dallas-based Comerica Inc. announced that Brian Goldman has been named senior executive vice president and chief risk officer, effective December 4. He succeeds Jay Oberg who is expected to retire in December 2024 following more than 32 years with Comerica. Oberg will remain a senior executive vice president at Comerica until his retirement.

“Brian has proven leadership and experience in directing enterprise risk,” notes Curt Farmer, chairman, president and CEO. “We are pleased to welcome him to Comerica to further advance our program as the banking industry continues to experience change. Jay has played an important role in numerous accomplishments that have helped strengthen Comerica’s risk foundation, and we wish him all the best as he prepares for retirement.”

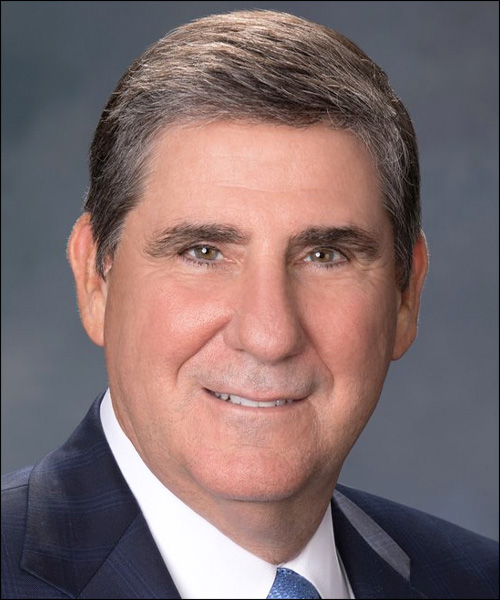

Goldman has had numerous risk management roles at both Goldman Sachs and Citibank, most recently serving as head of operational risk for the institutional clients group and Citibank NA, the primary U.S. banking subsidiary of Citigroup. Goldman spent 23 of his 26 years at Goldman Sachs in leadership roles. He was previously the chief risk officer for the operations division before serving as head of enterprise risk management for which he established the organization’s enterprise risk management framework. He then served as head of operational risk, overseeing the identification, monitoring, reporting and mitigation of all operational risks. Goldman earned his bachelor’s degree in history from Rutgers University.

Goldman has had numerous risk management roles at both Goldman Sachs and Citibank, most recently serving as head of operational risk for the institutional clients group and Citibank NA, the primary U.S. banking subsidiary of Citigroup. Goldman spent 23 of his 26 years at Goldman Sachs in leadership roles. He was previously the chief risk officer for the operations division before serving as head of enterprise risk management for which he established the organization’s enterprise risk management framework. He then served as head of operational risk, overseeing the identification, monitoring, reporting and mitigation of all operational risks. Goldman earned his bachelor’s degree in history from Rutgers University.

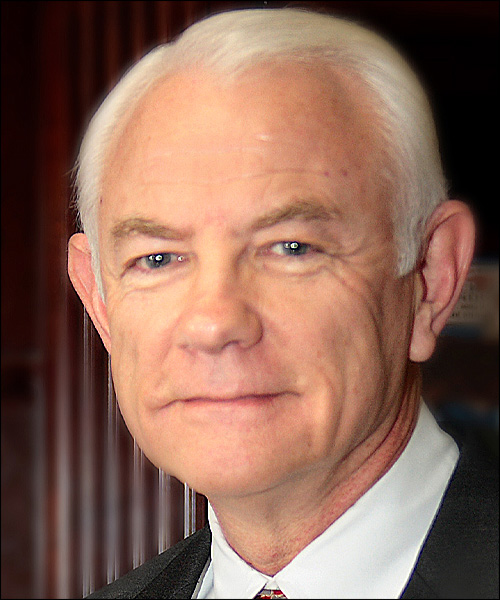

Oberg joined Comerica in 1991 as a financial analyst in the controller department. After moving to corporate development in 1995, his scope of work increased as he assumed leadership of Comerica’s corporate planning and development function in 2007. In 2016, Oberg’s role expanded as he began serving as executive vice president/corporate development, strategy and capital planning. He would go on to assume the role of chief risk officer in 2019. Oberg earned his bachelor’s degree in finance from the University of Michigan.

Oberg joined Comerica in 1991 as a financial analyst in the controller department. After moving to corporate development in 1995, his scope of work increased as he assumed leadership of Comerica’s corporate planning and development function in 2007. In 2016, Oberg’s role expanded as he began serving as executive vice president/corporate development, strategy and capital planning. He would go on to assume the role of chief risk officer in 2019. Oberg earned his bachelor’s degree in finance from the University of Michigan.

Established in 1849 in Detroit, Michigan, Comerica Bank has more than 400 banking centers across the country with locations in Arizona, California, Florida, Michigan and Texas.