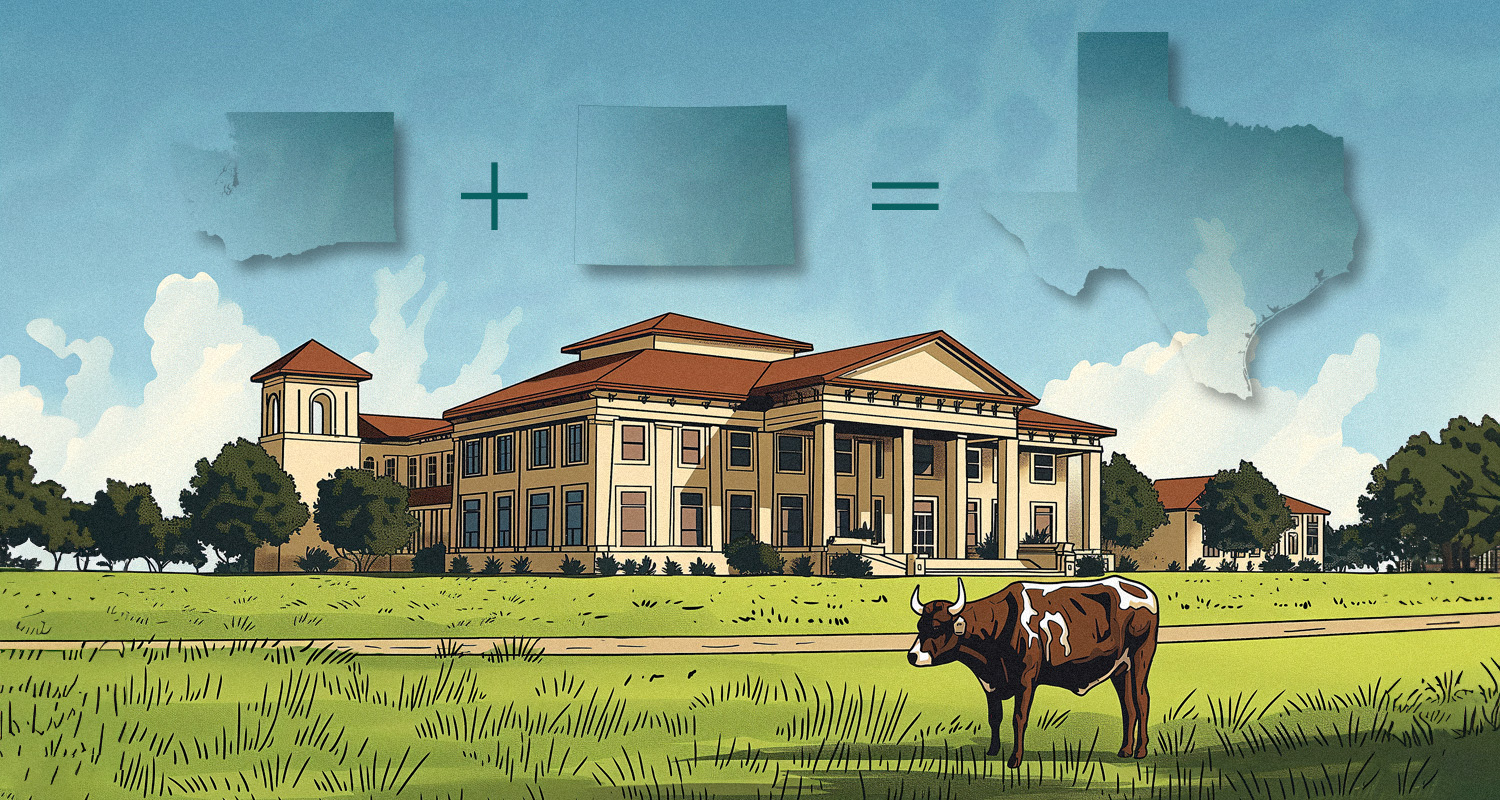

On April 30, Denver, Colorado-based FirstSun Capital Bancorp and Seattle, Washington-based HomeStreet Inc. announced that they have mutually agreed to amend their definitive merger agreement that was entered into on January 16. Among the amendments is the provision that “the combined company’s ongoing banking operations will operate under a Texas state charter with FirstSun Capital Bancorp’s subsidiary bank, Sunflower Bank, converting from a national bank to a Texas-state-chartered bank and that Sunflower Bank will also seek membership in the Federal Reserve System.”

FirstSun and HomeStreet each believe that a Texas state bank charter is the appropriate charter for the combined company’s banking operations since Sunflower Bank is now headquartered in Dallas. Under the amended merger agreement, the necessary bank regulatory approvals required to consummate the merger are the approval of the Federal Reserve Board and the Texas Department of Banking. In conjunction with the amendment to the merger agreement, the parties’ previous application with the Office of the Comptroller of the Currency in connection with the bank merger has been withdrawn.

“We greatly appreciate the long history we have had with the OCC, including the supervisory staff in our local markets who have been great partners over the years, and we look forward to working with the Texas Department of Banking and the Federal Reserve Bank of Dallas as we continue to grow our presence in the State of Texas,” says Neal Arnold, CEO of FirstSun Capital Bancorp and Sunflower Bank.

FirstSun Capital Bancorp is the financial holding company for Sunflower Bank NA, which operates as Sunflower Bank, First National 1870 and Guardian Mortgage. Sunflower Bank has a branch network in five states and mortgage capabilities in 43 states. FirstSun Capital Bancorp had total consolidated assets of $7.8 billion as of March 31, 2024.

HomeStreet Inc. operates as the bank holding company for HomeStreet Bank, which operates primarily in the Western U.S. HomeStreet had total assets of $9.5 billion and total deposits of $6.5 billion as of March 31, 2024, with a branch network in Washington, California, Oregon and Hawaii, along with lending offices in Utah and Idaho.